Algeria, the largest country in Africa by landmass, is a nation of remarkable potential. With its abundant natural resources, strategic Mediterranean location, and young, dynamic population, the country is at a pivotal point in its economic development. However, achieving its ambitious goals for sustainable growth and social development requires innovative approaches to financing. In this context, Algeria’s burgeoning capital markets hold the key to unlocking transformative opportunities through innovative financing for development.

The Need for Innovation in Financing

Algeria faces a dual challenge: diversifying its economy away from an over-reliance on hydrocarbons while addressing critical social and infrastructure needs. Traditional financing methods, such as government borrowing and foreign direct investment, are increasingly constrained by global economic uncertainties and fiscal pressures. As such, the focus has shifted to capital markets as a platform to attract new forms of investment that align with sustainable development goals.

Sukuk: A Sharia-Compliant Path to Growth

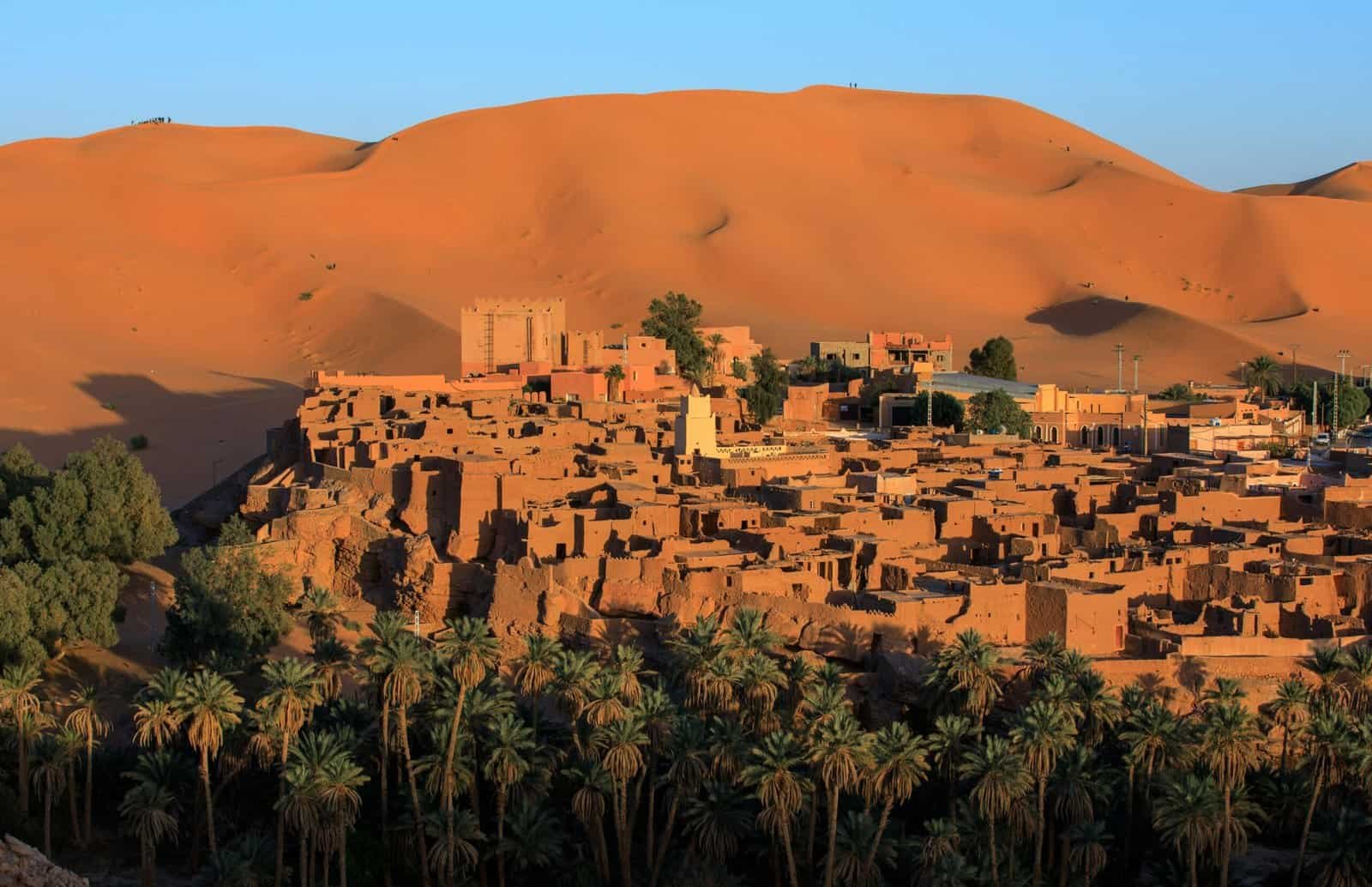

One of the most promising instruments in Algeria’s capital markets is Sukuk, or Islamic bonds. As a predominantly Muslim country, Algeria can leverage Sukuk to raise funds for infrastructure and development projects in a way that aligns with Islamic financial principles. Sukuk offers a unique opportunity to attract both domestic and international investors seeking Sharia-compliant investment options. The issuance of green Sukuk, in particular, could finance renewable energy projects, tapping into Algeria’s vast solar potential in the Sahara Desert.

Green Bonds: Financing a Sustainable Future

Algeria’s commitment to sustainability has opened the door for green bonds, a powerful tool for financing environmentally friendly projects. Green bonds could support initiatives such as expanding solar farms, improving water management systems, and developing eco-tourism infrastructure along the Mediterranean coast. The government’s collaboration with international financial institutions, such as the African Development Bank (AfDB), could further enhance the credibility and attractiveness of Algeria’s green bond market.

Diaspora Bonds: Harnessing the Power of the Algerian Diaspora

With millions of Algerians living abroad, diaspora bonds present an innovative way to mobilize resources. These bonds allow expatriates to invest in Algeria’s development while offering them a sense of ownership and connection to their homeland. The funds raised could support critical sectors such as healthcare, education, and digital transformation.

Blended Finance: Bridging the Gap

To bridge the financing gap for large-scale development projects, Algeria can adopt blended finance models. By combining public and private sector resources, blended finance can de-risk investments and attract private capital into high-impact areas such as renewable energy, urban development, and transportation infrastructure.

Challenges and Opportunities

While the potential is immense, Algeria must address key challenges to realize its capital markets aspirations. Enhancing regulatory frameworks, improving transparency, and fostering investor confidence are essential steps. Equally important is the need for capacity-building initiatives to strengthen the expertise of local financial institutions and market participants.

Despite these challenges, Algeria is uniquely positioned to benefit from innovative financing mechanisms. Its strategic partnerships with international organizations, coupled with its natural and human capital, provide a strong foundation for success.

The Road Ahead

Innovative financing for development is not just a necessity for Algeria; it is an opportunity to transform its economy and uplift its people. By leveraging tools like Sukuk, green bonds, diaspora bonds, and blended finance, Algeria can unlock the full potential of its capital markets and achieve sustainable, inclusive growth.

As the country takes bold steps toward economic diversification and sustainable development, the world will watch closely. Algeria’s journey in harnessing the power of capital markets serves as a blueprint for other emerging economies, showcasing how innovation in financing can create a brighter, more prosperous future for all.

Interesting article