The Green Credit Programme in India was launched in June 2023 by the Ministry of Environment, Forest and Climate Change (MoEFCC). This initiative aims to promote and incentivize environmentally sustainable actions across various sectors in India.

The Green Credit Programme in India: A New Pathway to Sustainable Growth

India has been at the forefront of numerous green initiatives, but the Green Credit Programme (GCP) stands out as a transformative policy framework that aims to drive sustainable environmental actions through financial incentives. Spearheaded by the Ministry of Environment, Forest and Climate Change (MoEFCC), this initiative is designed to encourage businesses, communities, and individuals to contribute toward preserving the environment. Let’s delve into how this programme fits into India’s broader sustainability goals and its relevance for international development finance and capital markets.

The Concept Behind the Green Credit Programme (GCP)

The Green Credit Programme is built on the principle of “green credits” – a market-driven mechanism where individuals or entities can earn credits by engaging in environmentally positive actions. These credits can then be traded or monetized, providing financial incentives for eco-friendly practices. Actions eligible for green credits include:

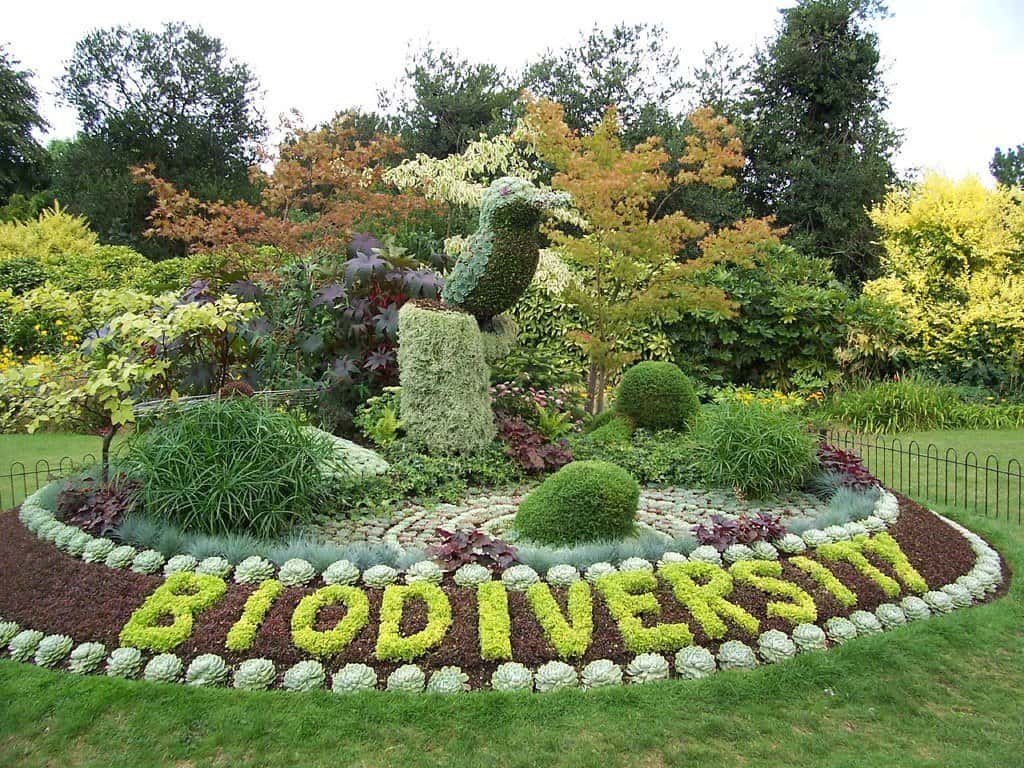

- Reforestation and Afforestation: Planting trees in degraded areas, creating green cover, and promoting biodiversity restoration.

- Sustainable Agriculture: Transitioning to organic farming, reducing water usage, and implementing soil conservation techniques.

- Waste Management: Encouraging recycling, reducing waste generation, and adopting responsible waste disposal systems.

- Energy Efficiency: Installing renewable energy solutions such as solar panels or using energy-efficient machinery in industries.

The GCP’s aim is to transform the mindset from merely following environmental regulations to actively investing in sustainability practices. It aligns perfectly with India’s commitments under the Paris Agreement and its national target to reduce carbon intensity by 45% by 2030.

How the Green Credit Programme in India Works

The GCP functions via a digital platform established by MoEFCC, which acts as a registry for green credit transactions. Eligible participants can record their environmental activities, and these activities are evaluated based on predefined criteria. Once approved, participants receive green credits. The key steps in this process are:

This mechanism is expected to unlock a new frontier of financial innovation, where environmental actions can be seamlessly integrated into capital markets.

Strategic Impact on India’s Financial Markets

The Green Credit Programme opens up exciting possibilities for both domestic and international financial markets. Here’s why:

- New Asset Class: Green credits, similar to carbon credits, represent a new asset class that can be traded in financial markets. They will likely attract interest from institutional investors looking to diversify into environmental, social, and governance (ESG)-oriented portfolios.

- Green Bonds Synergy: The existing green bond market in India, which has seen rapid growth, can benefit from this programme. Companies issuing green bonds can use the credits earned through GCP to boost their ESG credentials and further validate their green initiatives.

- Cross-border Trading: India’s green credit market could attract international attention, particularly from countries and companies with stringent emission reduction targets. This could lead to cross-border trading opportunities, where green credits are bought and sold across jurisdictions.

Financial Instruments and Capital Market Innovation

Capital markets are poised to play a central role in scaling the Green Credit Programme. Several potential financial instruments could emerge:

- Green Credit Derivatives: As the market for green credits grows, derivatives based on green credits could offer investors additional ways to hedge risks or speculate on the value of environmental activities.

- Green Mutual Funds: Mutual funds focused on acquiring green credits from companies or NGOs engaged in environmental projects could become a vehicle for retail investors to partake in the green economy.

- Green Exchange-Traded Funds (ETFs): ETFs tracking companies or projects that earn a significant portion of their revenues through green credits could also be developed, providing a simple and liquid way for investors to access this emerging market.

Encouraging Corporate Participation in the Green Credit Programme in India

Large Indian corporations are likely to be early adopters of the Green Credit Programme. Companies across sectors such as energy, manufacturing, and agriculture have a vested interest in reducing their environmental footprint, especially given rising consumer demand for sustainable products. By earning green credits, these corporations can not only improve their ESG ratings but also create additional revenue streams by selling excess credits in the market.

Social Impact and Grassroots Engagement

One of the GCP’s most compelling features is its inclusivity. The programme allows smaller entities—such as local farmers and small enterprises—to earn green credits. This could lead to greater grassroots participation in environmental conservation. By providing financial incentives, GCP could empower rural communities to adopt sustainable agricultural practices, reduce deforestation, and manage natural resources more effectively.

This bottom-up approach aligns with global goals of inclusive growth, allowing India to achieve environmental sustainability while promoting economic equity. It offers a pathway for local communities to benefit financially from their eco-friendly actions while contributing to a larger national and global cause.

Challenges and the Road Ahead

While the Green Credit Programme presents exciting opportunities, it also faces several challenges:

- Regulatory Oversight: Ensuring that green credits are accurately monitored and verified will be crucial to prevent misuse or greenwashing.

- Market Liquidity: As the programme is in its infancy, liquidity in the green credit market could be an initial hurdle. Creating robust market mechanisms will be essential to ensure transparency and fairness.

- Awareness and Engagement: For the GCP to truly succeed, widespread awareness and engagement will be necessary. This requires collaboration across government bodies, financial institutions, and civil society.

A Model for the Future

India’s Green Credit Programme is a bold and forward-thinking initiative that could reshape the country’s approach to environmental protection. By leveraging financial incentives, it provides a pragmatic solution to some of the most pressing challenges in sustainability. For investors, corporations, and local communities, the GCP offers not only a path to green growth but also a potential economic opportunity. It reflects a growing recognition that sustainable development must be both environmentally conscious and financially viable.

As the programme evolves, it is expected to attract significant attention from global capital markets, cementing India’s role as a leader in green finance and environmental innovation.

For financial institutions, ESG investors, and international development finance professionals, the Green Credit Programme presents a unique opportunity to be part of a burgeoning market that seeks to balance economic prosperity with ecological preservation.

Newswire: