ValueNature is investing in nature as a pioneering organization dedicated to transforming how we perceive and invest in natural assets. We explore ValueNature’s approach towards nature credits and biodiversity credits.

The Philosophy Behind ValueNature

ValueNature was founded on the principle that natural assets are not just environmental treasures but also valuable economic resources that can provide substantial returns. By assigning economic value to ecosystem services, such as carbon sequestration, water purification, and biodiversity, ValueNature aims to integrate nature into the financial system, creating incentives for its preservation and sustainable use.

ValueNature and Investing in Nature: Innovative Financial Instruments

ValueNature employs a range of innovative financial instruments to facilitate investments in natural assets. These instruments are designed to attract capital, provide financial returns, and generate positive environmental impacts.

1. Nature Credits

Nature Credits are at the forefront of ValueNature’s financial innovations. These credits represent quantified ecosystem services provided by natural assets, such as carbon sequestration by forests or water purification by wetlands. By purchasing Nature Credits, businesses and individuals can offset their environmental impact while funding conservation projects. The revenue from Nature Credits is reinvested into maintaining and enhancing the natural assets that generate these services.

2. Biodiversity Credits

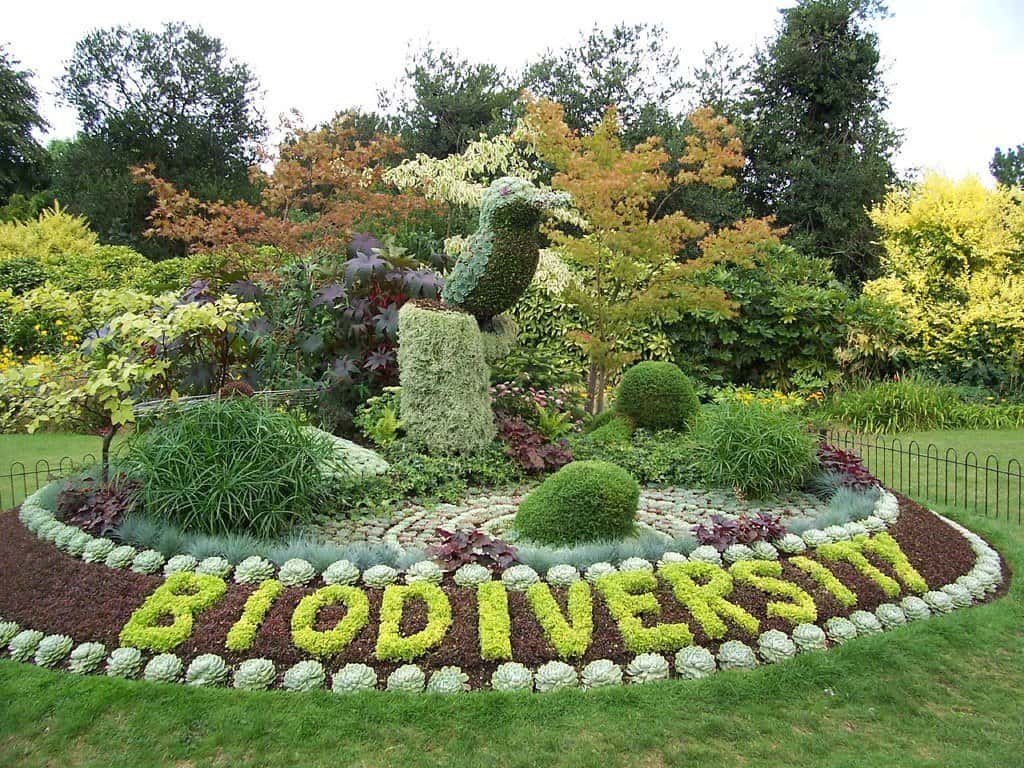

Biodiversity Credits are a novel addition to ValueNature’s suite of financial instruments. These credits are designed to quantify and monetize the biodiversity value of ecosystems, providing financial incentives for their conservation and restoration. Biodiversity Credits recognize the importance of species diversity and ecosystem health, offering a mechanism for investors to support projects that enhance biodiversity.

A Voluntary Biodiversity Credit represents a measured and evidenced-based unit of biodiversity gain and is differentiated from biodiversity offsets. Although none of the notable standard setters have finalised their methodologies to measure a Biodiversity Unit of Gain (Biodiversity Credit), ValueNature is working on 3 projects that have been identified as pilots, two for the Verra Nature Framework and one Plan Vivo’s Nature methodology.

Structure and Mechanism

- Biodiversity Assessment: The process begins with a thorough assessment of the biodiversity value of an ecosystem. This includes measuring species richness, habitat quality, and ecosystem services that support biodiversity.

- Certification and Issuance: Biodiversity Credits are certified by independent bodies to ensure their credibility and impact. Each credit represents a quantifiable improvement in biodiversity, such as the protection of a habitat or the restoration of a degraded ecosystem.

- Trading and Investment: Biodiversity Credits can be traded on environmental markets, allowing businesses and investors to support biodiversity conservation efforts. The funds generated from the sale of these credits are directed towards projects that protect and enhance biodiversity.

3. Green Bonds

ValueNature issues Green Bonds to finance projects that deliver environmental benefits. These bonds attract socially responsible investors who seek both financial returns and positive environmental outcomes. Projects funded by Green Bonds include renewable energy installations, reforestation initiatives, and sustainable agriculture practices. Green Bonds not only provide capital for these projects but also signal a commitment to sustainability from issuers and investors alike.

4. Conservation Trust Funds

To ensure the long-term sustainability of conservation efforts, ValueNature establishes Conservation Trust Funds. These funds provide a steady stream of financing for the protection and restoration of critical ecosystems. By pooling resources from various stakeholders, including governments, NGOs, and private investors, Conservation Trust Funds support ongoing conservation activities and create a financial buffer against economic fluctuations.

Strategic Initiatives

Beyond financial instruments, ValueNature implements strategic initiatives to promote sustainable investment in nature. These initiatives encompass policy advocacy, community engagement, and innovative project development.

1. Policy Advocacy

ValueNature works closely with policymakers to create an enabling environment for investments in natural assets. By advocating for policies that recognize the economic value of ecosystem services and provide incentives for their preservation, ValueNature helps to mainstream sustainable investment practices. This includes lobbying for tax incentives, subsidies for green projects, and stricter regulations on environmental degradation.

2. Community Engagement

ValueNature believes that local communities are key stakeholders in conservation efforts. The organization engages with communities to develop projects that benefit both people and the environment. This includes supporting sustainable livelihoods, such as eco-tourism and agroforestry, which provide economic incentives for conservation. By involving communities in project planning and implementation, ValueNature ensures that conservation efforts are inclusive and equitable.

3. Innovative Project Development

ValueNature identifies and develops cutting-edge projects that demonstrate the financial viability of investing in nature. These projects serve as models that can be replicated and scaled up globally. Examples include:

- Reforestation and Carbon Sequestration: ValueNature collaborates with landowners and governments to reforest degraded areas, enhancing carbon sequestration and biodiversity. These projects generate carbon credits that can be sold to offset emissions, providing a revenue stream for ongoing conservation efforts.

- Wetland Restoration and Water Management: In coastal and riparian areas, ValueNature restores wetlands to improve water quality, reduce flooding, and enhance habitat for wildlife. These projects leverage payments for ecosystem services and government funding to finance restoration activities.

- Sustainable Agriculture and Agroforestry: ValueNature promotes sustainable agriculture practices that enhance soil fertility, increase crop yields, and reduce environmental impact. Agroforestry projects, which integrate trees into agricultural landscapes, provide multiple benefits, including carbon sequestration, biodiversity conservation, and improved livelihoods for farmers.

Case Study: Restoring the Mangroves of Southeast Asia

One of ValueNature’s flagship projects involves the restoration of mangrove forests in Southeast Asia. Mangroves are critical ecosystems that provide a range of ecosystem services, including carbon sequestration, coastal protection, and habitat for marine life. Despite their importance, mangroves are under threat from deforestation and coastal development.

ValueNature’s project aims to restore and protect these vital ecosystems by implementing a multi-faceted approach:

- Nature Credits: The carbon sequestration potential of restored mangroves is quantified, and Nature Credits are issued. These credits are sold to businesses and governments seeking to offset their carbon emissions.

- Biodiversity Credits: The biodiversity value of the mangrove ecosystem is assessed, and Biodiversity Credits are issued. These credits attract investment for further conservation efforts, ensuring the long-term protection of the ecosystem.

- Community Engagement: Local communities are involved in planting and maintaining mangroves, providing them with sustainable livelihoods. Eco-tourism initiatives generate additional income and raise awareness about the importance of mangroves.

- Policy Advocacy: ValueNature works with local and national governments to strengthen regulations protecting mangroves and provide incentives for conservation.

The project has successfully restored thousands of hectares of mangroves, sequestered significant amounts of carbon, and improved the livelihoods of local communities.

Conclusion: Valuenature and Investing in Nature

ValueNature’s approach to investing in nature represents a paradigm shift in how we value and protect our natural assets. By integrating ecosystem services into financial systems and implementing strategic initiatives, ValueNature is creating a sustainable and resilient future where economic development and environmental stewardship go hand in hand. As we face the challenges of climate change and biodiversity loss, innovative solutions like those offered by ValueNature are essential for building a #WorldOfNature where people and the planet thrive together.

Newswire:

On 25 July 2024, ValueNature announced a strategic partnership with CreditNature to work together on investing in nature.